Golden Opportunity?

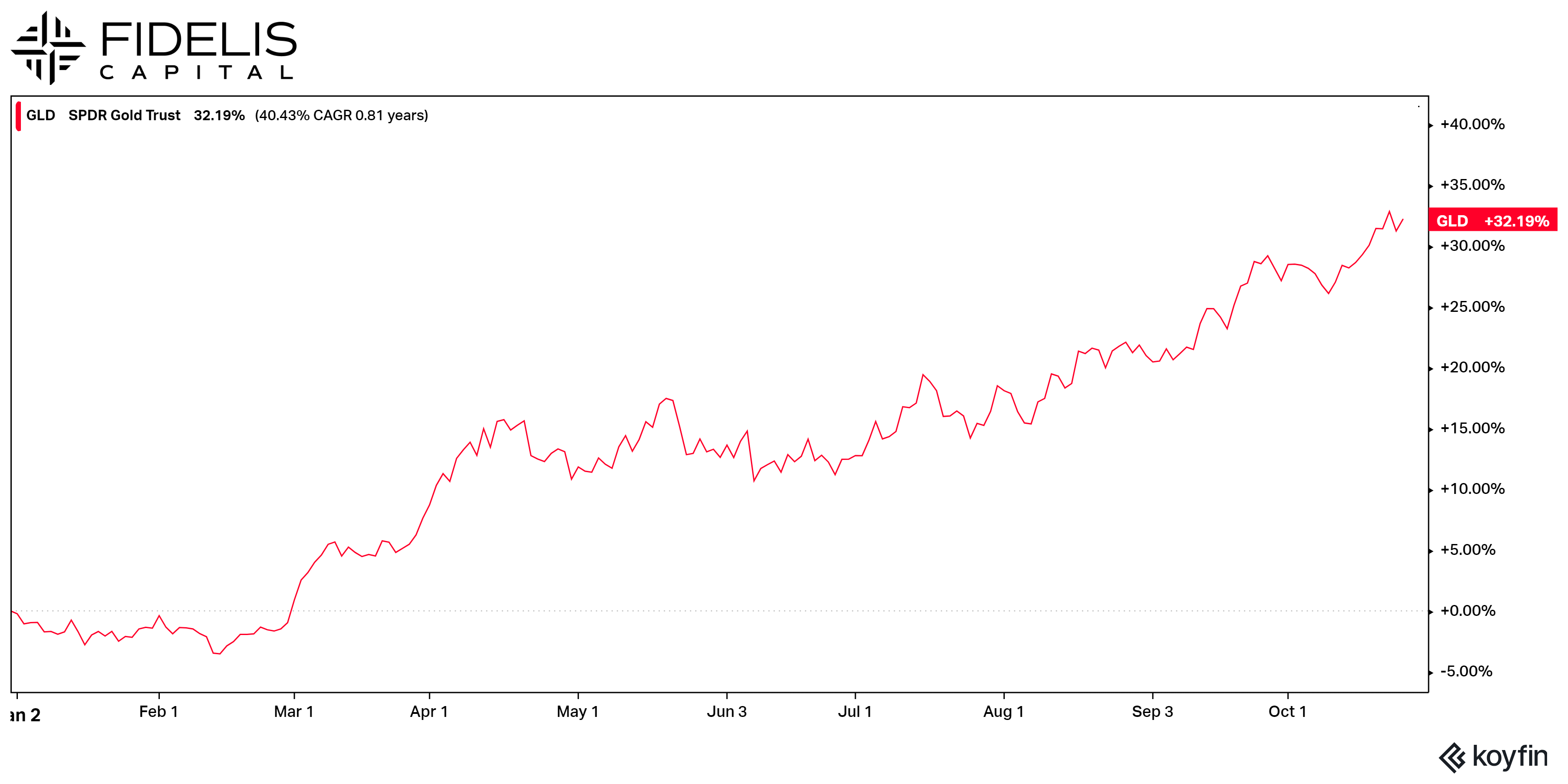

Through the market close on October 24, gold has returned 32.19% on the year and posted 35 new all-time highs. It is logical that gold would do well in a year with escalating geopolitical tensions, but what is driving its performance to outpace the overall stock market?

Gold is commonly seen as a long-term hedge in portfolios for two reasons: it is a safe-haven asset during market dislocations and a reliable inflation hedge as a commodity. Within portfolios, gold is considered a risk diversifier. Its correlation to stocks turns negative during market turmoil, meaning that its value increases when stock values are decreasing. Gold allocations are generally modest in portfolios because, in times of stability, it can be a drag.

Since gold is a physical asset, supply and demand play a significant role in its price. According to State Street Global Advisor’s Chief Gold Strategist George Milling-Stanley, “Over the past five years, demand for gold has been dominated by jewelry, averaging 47%; investments in coins, small bars, and exchange traded funds (ETFs) at 28%; and net central bank purchases for official reserves at 17%. Industrial and Technological demand, a catch-all category for analysts, has averaged just 8%.”

Demand for those last two components has been, and is likely to continue, increasing. Milling-Stanley notes that Q2 2024 saw double-digit demand growth for the third straight quarter. The technological demand can be partially attributed to semiconductors and other electronic devices. Gold is a useful input for these devices because of its high conductivity and corrosion resistance. This technological demand is a bullish driver over the long haul.

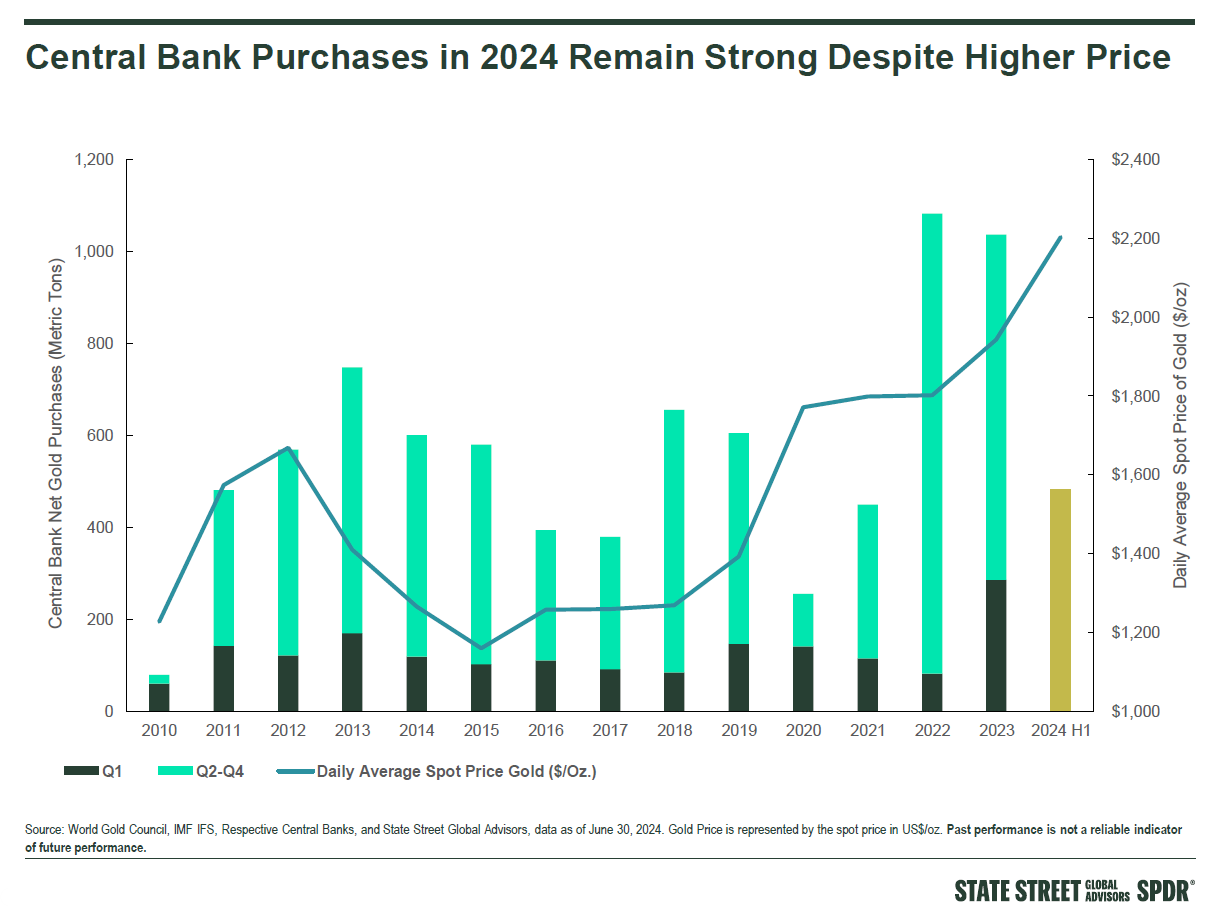

The second major demand component on the rise is central bank purchases. Central banks, especially in economies with weaker currencies, hold reserves in stronger currencies to increase their standing. Common reserve currencies are the U.S. dollar, Swiss franc and Japanese yen.

When Russia invaded Ukraine, economic sanctions were established against Russia. Ryan Grabinski from Strategas Research Partners refers to this as “weaponization of the dollar against foreign adversaries.” This created a push for foreign central banks to lower their reliance on Western currencies, causing an increase in the purchase of gold for reserves.

Fast forward to today and there is even more geopolitical uncertainty, continuing the case for these institutions to buy gold. As you can see from the chart below, central bank purchasing has remained strong despite rising gold prices.

Diversification and safety during market turbulence are the main reasons to hold an allocation, but gold is also benefitting from secular trends that should persist in the near future. We continue to believe that gold is a smart asset for the right portfolio.