Looking ahead to next week, it is once again time for our quarterly Market Outlook Webinar. Join Investment Committee members next Wednesday, October 23 at 4:30pm ET to hear our latest market insights and portfolio positioning commentary as we look to close out the year.

Happy Birthday, Bull Market

October 2022 was a challenging time for both investors and equity markets. The S&P 500 was enduring its worst year since 2008, and inflation (CPI) stood at 7.7% after peaking at 9.1% in June. The Federal Reserve raised interest rates by 300 basis points over the previous five meetings. No one knew at the time, but the Fed would hike rates by an additional 225 basis points. At the time, market sentiment was low and the consensus forecast was for a sharp U.S. recession in 2023.After the S&P 500 reached a bear market low of 3,577, stocks began to climb in mid-October. Since October 12, 2022, the S&P 500 has surged over 60%, defying recession fears, restrictive monetary policies, rising interest rates and heightened geopolitical tensions in Europe, Asia and the Middle East—and a highly charged U.S. presidential election cycle.

The durability of the market rally can be attributed to several factors: a resilient U.S. consumer, a historically strong labor market, excitement about AI-related technologies and surprising strong corporate profits, to name a few.

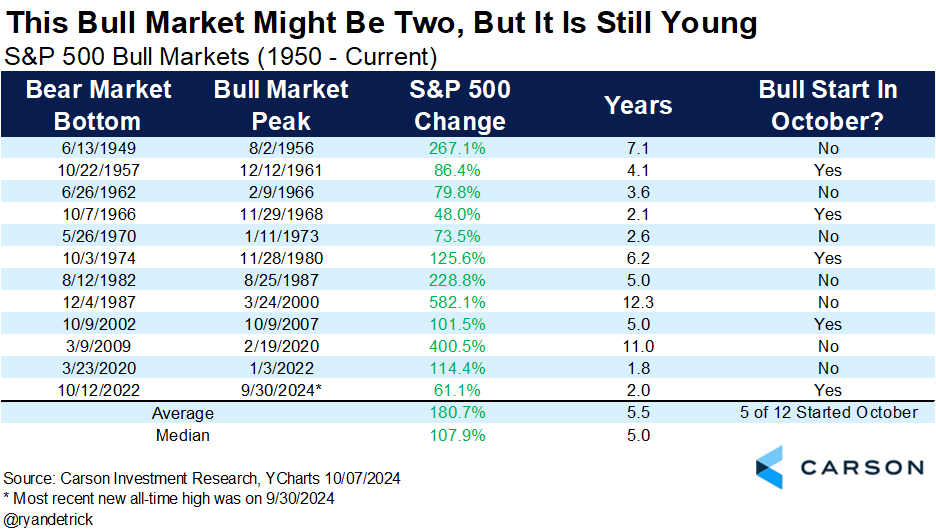

Where do we go from here? According to Ryan Detrick, chief market strategist at the Carson Group, the average bull market has a lifespan of 5.5 years with returns of 180% since 1950.

The economic environment also remains favorable as we enter the third year of this market, which should support continued growth. Recent trends show strong GDP growth, the U.S. labor market at full employment, resilient consumer spending and inflation levels that have prompted the Federal Reserve to cut rates for the first time in four years.

That's the positive news. However, Detrick’s research indicates that the third year of a bull market typically yields lower returns compared to the first two years, with an average return of 7.8% versus 37.8% and 14.7% in the first and second years, respectively.

What does this mean for investors? Historically, equities should have room to run. For the reasons mentioned above, the economic outlook is improving as we close out 2024 and investors should anticipate positive returns, though likely muted ones compared to recent years.

The key takeaway is that the easier phase of the cycle—marked by the last two years of strong gains—is behind us. As we enter the third year of this bull market, investors should adjust their expectations. While history suggests there is still room for growth, overall returns may be more modest and increased volatility is possible.