As an honorary mention, the September PCE price index increased 0.2% month-over-month, as forecasted. Core PCE, the Fed's preferred inflation measure that excludes food and energy, also increased as expected, by 0.3% MOM.

Before the Election: GDP, Earnings and Jobs

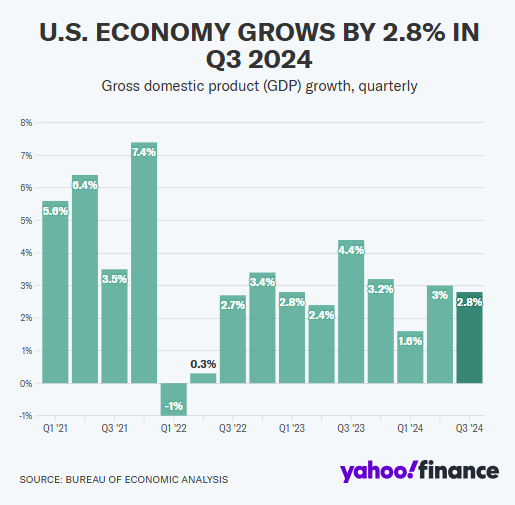

3rd Quarter GDP: Growth Still Strong

On Wednesday, the Commerce Department reported third quarter GDP at 2.8%. While this marks 10 consecutive quarters of macroeconomic growth, it falls slightly below both consensus estimates of 3.1% and the second quarter's 3.0%.

What did we learn from the report?

One, the U.S consumer remains resilient. While the topline growth number was slightly short of expectations, the data around consumer activity continues to remain strong as personal consumption expenditures increased 3.7% in the quarter, the highest read since Q1 of 2023. A notable increase in durable goods spending – think cars, furniture, electronics – of 8.1% contributed to the robust consumer spend number.

Two, the government spending continues at a torrid pace – 5.0% for the quarter. This is highlighted by a federal spending increase of 9.7% in the quarter, mainly attributed to defense spending.

Three, business spending is still strong, with non-residential fixed investment growing at 3.3%. Notable business spending increases were in information processing equipment (+14.7%) and transportation equipment (+25.9%).

The biggest detractor in the topline number was a growing trade deficit. Imports unexpectedly surged 11.2% while exports grew at a respectable 8.9%. The sharp jump in imports likely reflects companies pulling forward inventory ahead of the looming East Coast port strike. The strike, which was feared to run for weeks, ultimately lasted October 1-3.

In summary, the first take on third quarter GDP (keep in mind we will get two more revisions) was positive but largely confirms what we already know: the U.S. economy is on relatively sound footing.

Q3 Earnings: Trudging Forward

We are roughly halfway through third quarter earnings and results are mixed. Expectations coming into the quarter were tepid, with projected earnings of roughly 3%, significantly lower than the actual earnings of 11.8% in Q2 and 7.0% in Q1.Thus far, blended growth rate (reported earnings plus expected from companies yet to report) is at 3.6%. If that figure stands, it would represent the fifth straight quarter of year-over-year earnings growth though would be lowest reported rate since Q2 2023 (-4.2%).

From a sector perspective, Technology, Communications and Utilities have had the strongest results, while Industrials, Materials and Energy have had the weakest reporting season this far.

We would be remiss to point out that, according to FactSet, earnings are expected to rebound in Q4 to 13.4%, and be roughly 15% for 2025.

October Jobs: Noise Fuels Miss

This morning, the most recent employment report was released, and the major headline is that the number of jobs added missed estimates. The change in non-farm payrolls was 12k versus an expectation of 100k.Before we read too heavily into this disappointing number, it is important to recall the “noise” affecting this data. Hurricane Helene hit at the very end of September and was followed by Hurricane Milton in October. Mass evacuations paired with general disruption from the hurricane fallout undoubtedly have an impact on this data. There were also two major strikes in October, and the ongoing Boeing strike has had a notable impact on the manufacturing payrolls, bringing the total number lower.

Importantly, the unemployment rate remained unchanged at 4.1%. We’ll be spending the next few days trying to separate out the noise to properly interpret if this negative report is a signal or an outlier.