Cars: The Latest Tariff Target

The supply chain that goes into manufacturing cars has been subject to major globalization. Take the Dodge Ram 1500. What is more American than a big pickup truck?Well, according to the data collected annually by NHTSA, 32% of the parts are sourced from Mexico. The Ram 1500 is assembled in the U.S., but that won’t fully insulate it from tariffs because Chrysler, its manufacturer, sources parts from a variety of countries. Exceptions could be made for the U.S.-Mexico-Canada (USMCA) trade agreement. We saw the administration use this in the most recent tariff negotiations with Canada and Mexico as a way to ease the ultimate burden. For now, however, this initial announcement is light on exceptions.

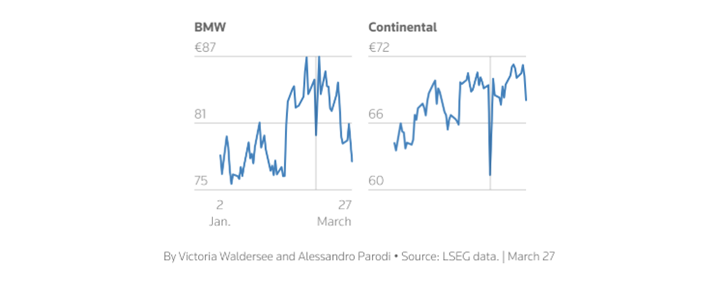

This move was likely made to prevent backdoor ways around the tariffs. For example, BMW assembles cars for its U.S. customers in the U.S., but they are constructed primarily with imported parts.

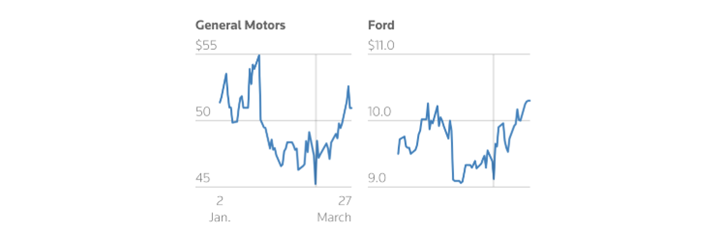

Charts: Auto Stock Responses to Tariffs

Tariff Day: April 2

While this latest tariff is important, the real focus will be on the announcements coming next week. There are two key types of policy that will be announced: sector tariffs and reciprocal tariffs.Sector tariffs, like what was just put in place on automobiles, will be felt more immediately.

Reciprocal tariffs seek to adjust U.S. tariffs to match levels imposed on the country by other nations. These tariffs may be somewhat minimal increases, but they could be adjusted for countries with a value-added tax (VAT). A VAT is essentially a more complex version of sales tax that is common across the globe. VAT rates vary based on the country, so trying to factor these into the calculations could increase the complexity and scale of policy moving forward.

Plenty more to come here, and we’ll be sure to communicate our up-to-date thoughts once the plan is announced on April 2.