The Stargate Project

On Tuesday, President Trump announced a four-year, $500-billion initiative for investment in AI infrastructure—the Stargate Project. Flanked by Oracle Chairman Larry Ellison, SoftBank CEO Masoyoshi Son and OpenAI CEO Sam Altman, Trump shared how this investment (and future ones like it) will help provide economic opportunity across the U.S. while shoring up our infrastructure as the AI arms race against China builds.Stargate will be a company primarily operated by OpenAI and funded by SoftBank. OpenAI and Oracle, along with Nvidia, Arm and Microsoft, are key technological partners for the endeavor.

The initial $100 billion investment, funding physical infrastructure to support the ongoing need for more computing power, is already deployed. One of the first buildouts is currently underway—a one-million-square-foot data center in Texas.

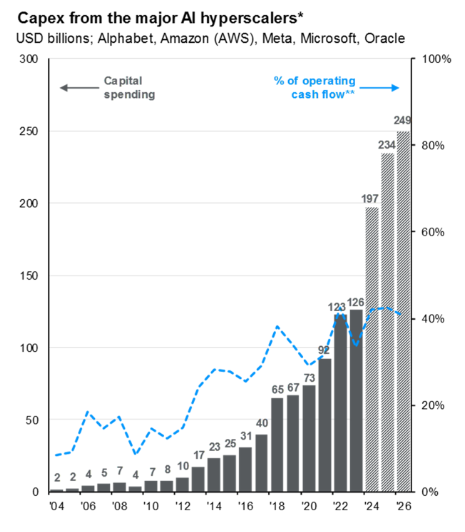

Spending on AI infrastructure has been a major theme since the unveiling of OpenAI’s ChatGPT in November 2022. Data centers serve as the proverbial power plants that allow complex AI models to train and operate, and the major technology companies, often referred to as “hyperscalers,” are sinking tremendous amounts of capital into bringing these new projects online.

Some words of caution. These centers consume significant energy around the clock, so a major challenge with deploying them is securing energy from the grid at an affordable price. There are also mixed opinions on how long it will take for these investments to translate into profitability. A quote from Bill Gates comes to mind, “We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten.”

AI will continue to be a dominant theme as we look forward and should continue to create investment opportunities, but we’ll need to be thoughtful about our expectations on this revolution’s timeline.