- Historic Two-Year S&P 500 Run

- 2025 Expectations for the S&P 500

- At A Glance: 2025 Fed Meetings

- 2025 Earnings Growth Projections

Historic Two-Year S&P 500 Run

The S&P 500 has delivered back-to-back returns of more than 20% only four times in history. In two of those instances, the third year saw negative returns – dramatically negative in the case of 1937, when a recession struck during the Great Depression recovery. In the 1950s, this environment was a precursor for a relatively flat third year. Most recently, in the 1990s, we saw a third straight year of more than 20% returns.While past performance is never a reliable predictor of future results, it is worth noting how rare this level of market strength is and how previous instances played out.

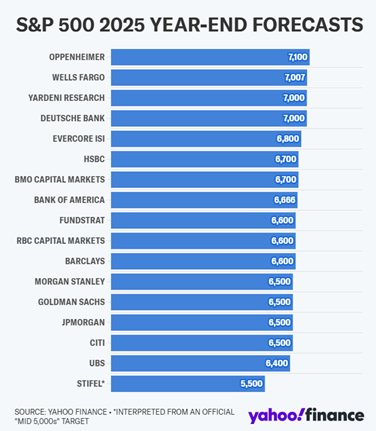

2025 Expectations for the S&P 500

Wall Street expectations for 2025 generally skew positive. After closing at 5,881.63 on the last day of 2024, the average S&P 500 return expectation is 12.69%, based on the data below.Notably, these forecasts are not simply based on the idea that the Fed will be lowering interest rates (more on that in a second), but that there will be some tailwinds in the form of more favorable tax policy and deregulation from the new administration. We expect that this year will show a re-emergence of volatility, as these goals are unlikely to be achieved without twists and turns.

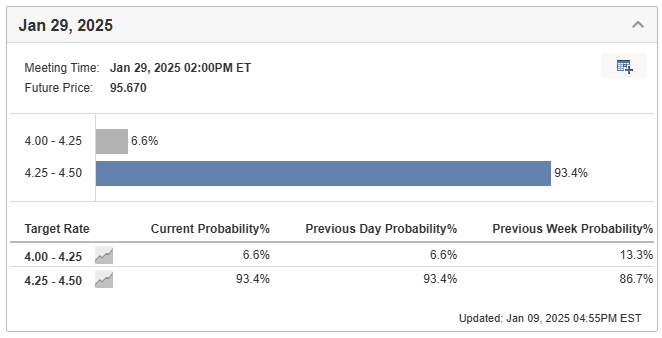

At A Glance: 2025 Fed Meetings

After the Fed’s last meeting featured more hawkish commentary, the market has moved quickly to price in fewer interest rate cuts in 2025. The chart below shows the current odds, based on the pricing of fed funds futures, for a cut at the upcoming January meeting. The runaway favorite is for the Fed to hold interest rates at their current level and change course from the last few meetings, which resulted in rate cuts.For all of 2025, the market is currently pricing in just 1-2 cuts. This goes back to the idea that the new administration’s policies may serve as economic tailwinds, which increase the risk of inflation starting to tick higher. We expect the Fed to be cautious over the next few months and remain data-dependent when evaluating upcoming policy decisions.

2025 Earnings Growth Projections

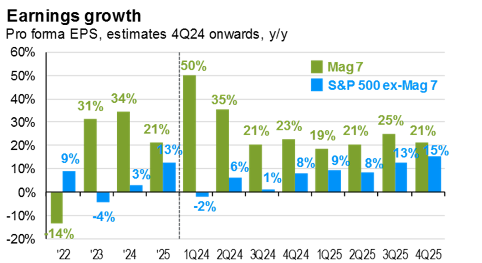

The final chart shows historical and forward earnings projections for the Magnificent Seven and the remaining 493 companies in the S&P 500. As index concentration continues to be a dominant theme within the U.S. large-cap indices, assessing the earnings contribution for these larger companies is critical.In 2023 and 2024, we saw major contribution from the Magnificent Seven, while the remainder of the large-cap market was relatively flat. A major part of the optimism for equities in 2025 is the potential for this gap to narrow, meaning that 493 other companies in the S&P 500 start to meaningfully contribute to overall earnings.

If the economy remains on solid footing, the market should broaden and these other companies should have the opportunity to start meaningfully contributing to overall earnings. This would be a strong signal for the overall health of the market.