On Wednesday, U.S. defense stocks moved lower after reports that the Elon Musk-led Department of Government Efficiency, better known as DOGE, has its sights set on the Pentagon and defense spending.

On Thursday, Walmart announced strong earnings but also cautioned that its 2025 outlook is going to be weaker than previously expected. The market took this as a sign of concern about the state of the U.S. consumer, bringing consumer-related stocks and consumer-sensitive banking stocks lower for the session.

With this recent news, we thought it would be relevant to take a pulse check on the U.S. consumer in the early stages of 2025.

The U.S. Consumer Remains Healthy

Over the last two years, it is no secret that the U.S. consumer has been the main catalyst of stronger-than-expected domestic growth. Consumption makes up approximately 68% of U.S. GDP, with GDP rising 2.9% in 2023 and estimated to grow 2.8% in 2024 (pending final numbers). A stronger consumer typically leads to stronger growth.The good news is that growth is still expected to remain strong in 2025. According to a survey conducted by the Philadelphia Fed, U.S. growth is projected to be 2.4% for 2025. Still firmly on the positive side of the ledger, but not quite as strong as we experienced over the last two years.

From our vantage point, the consumer still looks relatively strong. Jobs have increased 1.4% over the last 12 months, the unemployment rate is still at the lower end of the historical scale at 4.0%, and wage gains adjusted for inflation increased 2.6% over the last year. We would expect these trends to continue into 2025.

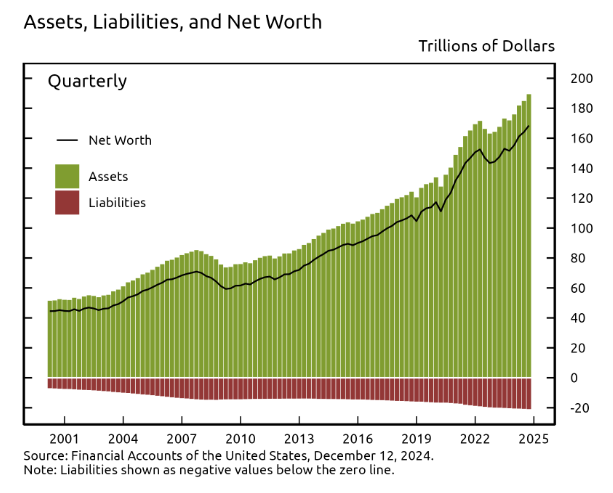

Furthermore, household savings are still above pre-pandemic levels at $1.1 trillion, and household net worth is at an all-time high, as depicted below.

More recently, the 2024 holiday spending season was strong, although retail sales were somewhat disappointing in January.

The takeaway is that the U.S. consumer remains healthy as we enter 2025. That being said, the bar for consumption is high given the growth over the last several years, so a slower, albeit positive, growth environment should be expected.