- Changes in the Summary of Economic Projections (SEP)

- Powell’s Hawkish Press Conference

- Broader Market Reaction

SEP Overview: What Changed?

On Wednesday, the Fed concluded its final meeting of 2024 by announcing a 0.25% interest rate cut—an action widely anticipated across the market. Although a cut may appear to be dovish, there were key components of this announcement that communicated the Fed is planning to be more hawkish moving forward. First, there was a dissenting vote from Cleveland Fed President Beth Hammack, who preferred to maintain the current target rate. This was only the second dissenting vote this year, and the first that supported no cut. (Michelle Bowman dissented in September, favoring a 0.25% cut instead of a 0.50% cut.)

The Fed is careful with its communication. Many believe this dissent is meant to signal that the committee is starting to become divided on whether more cuts are necessary in the immediate future.

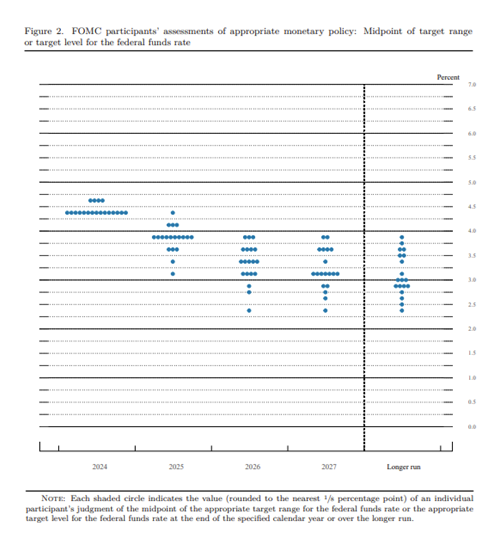

Next, there were notable changes in the Summary of Economic Projections (SEP). As a refresher, the SEP is a survey of all the Federal Open Market Committee (FOMC) participants’ economic forecasts. This SEP, compared to the last one released in September, had major shifts in the short-run expectations for inflation, growth and unemployment.

For growth, expectations for 2024 increased from 2% to 2.5%, likely a reflection of the strong economic data that has been received as of late. Next year’s growth also had a median response of 2.1% versus 2.0%, a slight increase. For unemployment, the median response was 4.3% for 2025, a revision lower from 4.4%. The most significant changes were reflected in inflation. PCE inflation was revised from 2.1% to 2.5% for 2025.

Collectively, we can see that the Fed is adjusting its view towards higher growth, lower unemployment and higher inflation expectations. All of these play into the idea that the Fed is likely moving to a stance that features limited interest rate cuts in 2025, as their scale seems to be tipping more towards concern about inflation than the labor market. This is highlighted more specifically in the dot plot projections below.

In September, the responses for 2025 were generally clustered around 3.0%-3.5%. Now, the majority of participants see the appropriate fed funds rate between 3.5%-3.75%. This shift caused the market to adjust its forecast to only include two to three cuts next year.

One final note on the SEP. If you review the report, you will notice that the long-run projections for the Fed have remained consistent. These projections are generally less reliable.

Think about it: the Fed’s monetary policy is a significant driver of these economic variables. The Fed also believes that it is making the right decisions and that it will continue to make the right decisions.

It would be odd if the Fed showed anything but positive long-run forecasts. That would indicate the Fed doesn’t have confidence in its current decision making. With this in mind, we always take the long-run numbers with a grain of salt.

Powell's Hawkish Press Conference

Powell’s press conferences are must-see television within the financial world. They provide him the opportunity to downplay or emphasize important takeaways from the data release and interest rate decision.Powell seemed to be intentionally more hawkish in his commentary and signaled that stronger than expected economic growth, paired with loosening monetary policy, could spell trouble for inflation. It’s always important to remember the Fed’s dual mandate—promoting full employment and maintaining stable prices. In regard price stability, remember the Fed has set a self-imposed target inflation rate of 2%.

Since the first interest rate cut in September of 0.50%, Fed focus was seemingly tipped towards the labor market. Unemployment had started to rise, prompting the Fed to cut rates in an attempt to prevent additional weakening. The Fed’s action this week (cutting rates) signals that this is still important, but there will likely be a more balanced focus in the new year.

“Our monetary policy actions are guided by our dual mandate to promote maximum employment and stable prices for the American people. We see the risks to achieving our employment and inflation goals as being roughly in balance, and we are attentive to the risks on both sides of our mandate.”

Powell is trying to impart that the Fed believes the economy is still susceptible to both risks. He is trying to communicate that the Fed wants to keep multiple options on the table at this time so it can be responsive if the scales start to tip in one direction. The broad takeaway from his Q&A, however, is that inflation seems like it will be a bigger driver of decision making for next year.

“I'll give you some details on why. Downside risks to the labor market do appear to have diminished, but the labor market is now looser than pre-pandemic and it's clearly still cooling further. So far, in a gradual and orderly way. We don't think we need further cooling in the labor market to get inflation down to 2 percent.”

Statements like this are what drove the market response and underscored the Fed’s tilt towards a more hawkish position.

Broader Market Reaction

Powell’s presser sparked a negative reaction across markets. Interest rates rose across the board. The 10-year Treasury crossed 4.50%, a signal that markets are pricing in the potential for a higher inflation/growth regime in 2025. Less monetary support moderated the post-election equity rally as the goldilocks scenario of easing monetary policy, paired with the hope of supportive fiscal policy, from the new administration were dashed.Keep in mind, the S&P 500 is still up more than 20% on a year-to-date basis. Markets opened Thursday significantly less volatile, a good sign that the market is still on strong long-term footing.