November CPI: As Expected, But Stubborn

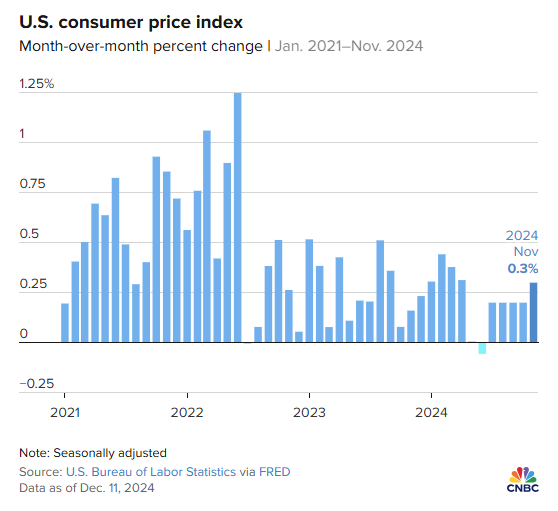

Wednesday’s Consumer Price Index (CPI) rose 2.7% year-over-year, which was in line with consensus expectations. CPI rose 0.3% from the prior month, indicating the strongest month-over-month increase since July. Core CPI, which excludes food and energy costs, remained unchanged at 3.3%.

The largest increases were seen in groceries and new vehicles. Rents, one of the stickier components of recent CPI readings, rose at the slowest month-over-month pace in three and a half years.

Thursday’s Producer Price Index (PPI) also suggested the downward trend in inflation could be stalling, reporting an increase of 0.4% in November, higher than consensus forecasts of 0.2%.

What should investors take away from this data? While the annual inflation rate has slowed considerably from its peak of 9.1% in June 2022, achieving the Fed’s 2% target is proving increasingly difficult. This challenge is further complicated by the threat of new tariffs from the incoming Trump administration, which could exert additional inflationary pressures.

At the same time, the Federal Reserve faces mounting pressure. It has signaled a willingness to cut rates to support a softening labor market, which reported an increase in the unemployment rate to 4.2% in November. The Fed’s next meeting, scheduled for December 17-18, is widely expected to result in a rate cut of 25 basis points, with fed fund futures pricing in a 95% likelihood of this outcome.

The Fed’s path in 2025 is becoming less clear, with markets pricing in a less than 25% chance for a cut in January, followed by a roughly 50% chance in March.

What do we see in the near future? The interest rate and inflation backdrop will remain fluid, at least in the early part of 2025. A stall in the inflation rate above the Fed’s target, plus the threat of looming tariffs, suggests that inflation will remain stubborn at these levels. At the same time, the labor market continues to gradually cool. The Fed will look to balance its dual mandate goals—promoting full employment and maintaining stable prices.