There is a lot to unpack across the market, so we’ll focus our comments this morning on the announcement, its impact on the market and what we are monitoring over the next week.

"Liberation Day"

Markets closed slightly higher on Wednesday as rumors of a paired back tariff announcement began to circulate. As Trump started talking, his comments initially checked all the expected boxes. Markets were rising through this part of the speech, but once he pulled out the charts that detailed the tariffs on various countries, markets quickly reversed and took a big step lower.The main takeaways from the speech are that all countries will be subject to a universal 10% tariff, and countries deemed as bad actors (i.e., they have large trade deficits with the U.S.) will be subject to a higher “reciprocal” rate. In total, 57 countries were targeted.

Prior to this announcement, reciprocal had been thought to mean a 1:1 exchange of tariffs based on the target countries’ current tariffs on the U.S. The administration, on the other hand, weighed non-tariff trade barriers heavily into its ultimate calculation.

The Tariff Calculation

“Non-tariff barriers” is a purposely vague term and could include anything from value-added taxes (which we discussed in last week’s Insights linked here), immigration policy, government subsidies to specific industries, etc.

It would be very difficult to assess these on a nation-by-nation basis, so the administration created its own calculation. The formula and its rationale were released to the public and can be found here.

Quickly following the announcement, some spectators across the industry noticed the formula was easy to simplify. The Wall Street Journal boiled it down quite nicely, using China as an example.

In 2024, we imported $439 billion of goods from China and exported $144 billion of goods to China, resulting in a trade deficit of $295 billion. The trade deficit ($295 billion) divided by imports ($439 billion) equals 67%. The administration then divided this by two to reach the final figure of 34%, likely because the initial outcome was too high and unrealistic.

Notably, this calculation only includes goods and does not include services. Services are a big part of exports for the U.S., so omitting services pushes the deficits (and therefore the tariffs themselves) higher.

Why Focus on Trade Deficits?

Targeting trade deficits and tariffs are two very different things. The latter is a retaliation to specific trade barriers installed to make U.S. exports less competitive. The former, which is what this formula seems to lean towards, is about punishing trade deficits.

It is important to note that trade deficits on their own are not inherently negative. Some countries do create products more efficiently than others, so it makes economic sense that they export those products at a higher volume.

If the goal of shrinking these deficits is to bring manufacturing onshore, this may be a longer process with less room for negotiation than initially anticipated. We are carefully watching the international response to look for early indications of how much the administration is willing to play hardball.

In summary, this announcement caught the market off-guard in its construction and scale. To put the scale into perspective, the government collected $489.62 billion from the corporate income tax last year. Current estimates from Strategas Research Partners predict that these tariffs could collect $500 billion in revenue. This could spur Congress to consider expanding the 2017 tax cuts instead of just extending them. Tax policy will likely be the next key focus area for the administration—an attempt to hand out some candy after all of the spinach the last few days.

Market Reaction

Equity markets moved quickly against these new policies, with the S&P 500 falling 4.67% by Thursday’s close. Volatility ticked up as well, with the Volatility Index (VIX) finishing near 30, the highest level since August of last year.Per FactSet, 40% of revenue from S&P 500 companies comes from abroad. The announcement on Wednesday is the first wave, and companies will be working quickly to anticipate and fend off any barriers set up by the international community as retaliation.

We expect tariffs to be the main topic during Q1 earnings season, which is around the corner. Companies with higher exposure to outsourced manufacturing bore the brunt of the sell-off, but the pressure was nearly indiscriminate across sectors.

There are opportunities to be had in this type of volatility, but we remain on guard as this stress is likely to last for some time. If these tariffs remain for a long period of time, structural change will need to occur across the market. That isn’t expected to happen immediately, so we are doing everything we can to digest what is going on across the market and adapt our viewpoint appropriately.

There is a silver lining. Historically, policy uncertainty spikes, like we are seeing right now, tend to generate positive forward returns. This is because policy makers respond and are forced to act.

Fixed-Income Markets

As we review the market’s reaction to the tariff announcement, we see a mix of both good news and bad news. To state the obvious, market volatility and uncertainty have increased, but if we look through the headlines and deeper into the market’s reaction, we can glean information about how severe the current dislocation is compared to known previous events. Clearly, the immediate reaction has been a flight to quality.U.S. Treasuries

In financial markets, that means investor preference for cash and the safety of fixed income, specifically U.S. Treasuries. U.S. Treasury bonds have rallied and are trading around 3.09% yield to maturity as of Friday morning. That’s the lowest yield in six months, but yields were even lower back in September 2024, bottoming out at 3.62%. So, the implication is that there’s some concern but not yet exaggerated levels—we will continue to monitor.

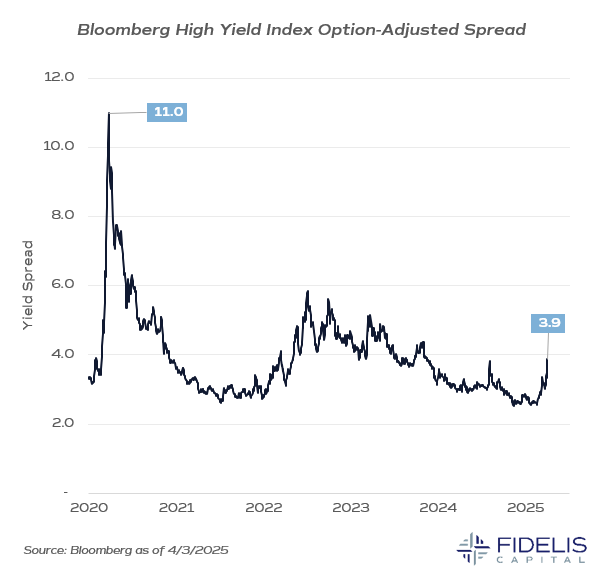

Corporate and High-Yield Bond Spreads

Another useful market measure is corporate and high-yield bond spreads. A bond’s yield spread is how much more yield a non-Treasury bond offers over a comparable Treasury bond. It’s a measure of risk. The more a bond yields above Treasuries, the more risk the market is implying.

The average additional spread for high-yield bonds, as measured by the Bloomberg High Yield Index, is at 3.87% as of Friday morning. The average for the last five years has been 3.83%, with a near-term peak during Covid of 11.0%. The current level is far from that extreme.

Fed Rate Cuts

Through the analysis of the fed funds futures market, we can also see if the market expects any changes in policy from the Federal Reserve because of the tariff announcement. Markets are now expecting a more than 1.00% reduction in the fed funds rate by the end of the year. Before the tariff announcement, the market expected a 0.50% reduction for all of 2025. This suggests a modest increase in the potential for a recession.

In the past, tariffs have been the source of near-term inflation. This time is no different, however the markets are showing a decline in long-term inflation expectations. This suggests that if we do see an increase in inflation, it likely won’t persist as long as it did during the Covid pandemic.

We will continue to monitor these market indicators as developments—stay tuned.

Questions We're Evaluating

- What is the international response?

- If there is retaliation, how will the administration approach it?

- If there is capitulation and countries lower their “trade barriers,” how does the administration adjust its policy towards that specific country?

- How do broader currency markets react over the next few trading sessions?

- Do we see evidence of market capitulation, that is, indiscriminate selling that tends to be a contrarian indicator of overreaction?

- Will this dislocation in the market cause policymakers to favor increased tax cuts instead of simply extending the 2017 tax cuts?

Closing Time

This is a rapidly developing situation, and we expect volatility to remain elevated to extreme levels over the next few trading sessions.We are diligently working through portfolios and hopping on the phone, so if you have any questions or concerns, please do not hesitate to reach out to a member of your Fidelis Capital team.